KYC/AML

What Is Know Your Client (KYC)?

KYC is an acronym for “Know your Customer”, a term used for customer identification process. It involves making reasonable efforts to determine true identity and beneficial ownership of accounts, source of funds, the nature of customer’s business, reasonableness of operations in the account in relation to the customer’s business, etc which in turn helps the financial institutions to manage their risks prudently. KYC has two components – Identity and Address. While identity remains the same, the address may change and hence the banks are required to periodically update their records. The objective of KYC guidelines is to prevent financial institutions from being used, intentionally or unintentionally, by criminal elements for money laundering activities. Related procedures also enable financial institutions especially banks to know or understand their

customers, and their financial dealings better. This helps them manage their risks prudently. Banks usually frame their KYC policies incorporating the following four key elements:

- Customer Acceptance Policy;

- Customer Identification Procedures;

- Monitoring of Transactions; and

- Risk management.

KYC controls typically include the following;

- Collection and analysis of basic identity information (referred to as “Customer

Identification Program”) - Name matching against lists of known parties (such as “politically exposed person” or

PEP) - Determination of the customer’s risk in terms of propensity to commit money laundering,

terrorist finance, or identity theft - Monitoring of a customer’s transactions against their expected behaviour and recorded

profile as well as that of the customer’s peers

What Is Know Your Client (KYC)?

Origin of concept of KYC

The concept of KYC is at once ancient and revolutionary. The nineteenth century shopkeeper built long-term relationships with his customers. The storeowner knew customers personally, could greet them, anticipate their needs, and win their continued business. In today’s markets dominated by large corporations, relationships cannot be built around a customer contacting the same company employee every time. Instead technology allows firms of all sizes to collect and store information about customers at every opportunity, and make it available to company employees in order to personalize the service whenever they have contact with customers. In essence, today’s company knows its customers through its database.1

Understanding Know Your Client (KYC)

The Know Your Client (KYC) rule is an ethical requirement for those in the securities industry who are dealing with customers during the opening and maintaining of accounts. There are two rules which were implemented in July 2012 that cover this topic together: Financial Industry Regulatory Authority (FINRA) Rule 2090 (Know Your Customer) and FINRA Rule 2111 (Suitability). These rules are in place to protect both the broker-dealer and the customer and so that brokers and firms deal fairly with clients.

The Know Your Customer Rule 2090 essentially states that every broker-dealer should use reasonable effort when opening and maintaining client accounts. It is a requirement to know and keep records on the essential facts of each customer, as well as identify each person who has authority to act on the customer’s behalf. The KYC rule is important at the beginning of a customer-broker relationship to establish the essential facts of each customer before any recommendations are made. The essential facts are those required to service the customer’s account effectively and to be aware of any special handling instructions for the account. Also, the broker-dealer needs to be familiar with each person who has the authority to act on behalf of the customer and needs to comply with all the laws, regulations, and rules of the securities industry.

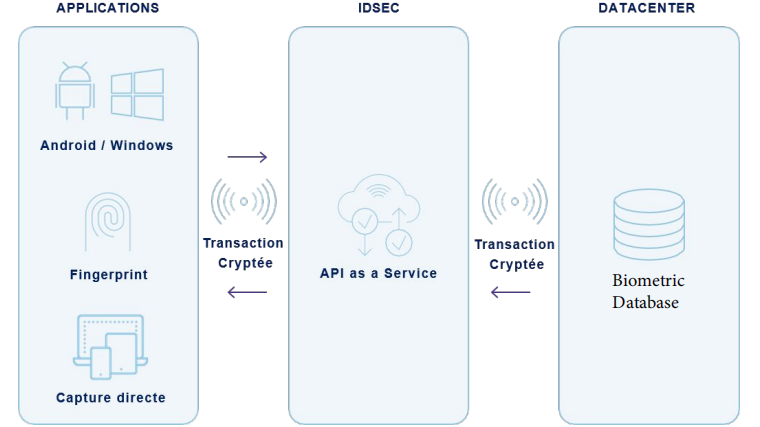

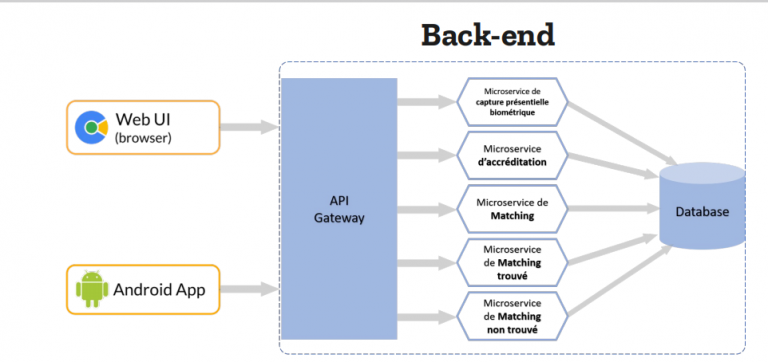

Our process of implementing the KYC standard of identification

We want to reassure ourselves that a customer X is who he claims to be, by checking his biometric data

What is Money Laundering?

According to Section 3 of Prevention of Money Laundering Act, 2002 – Whoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property will be guilty of offence of money-laundering. Financial Action Task Force on Money Laundering (FATF) defines money laundering as “the

processing of criminal proceeds to disguise their illegal origin in order to legitimize the ill-gotten gains of crime.”

Money laundering is frequently referred to as a financial crime. It is generally defined as “transferring illegally obtained money or investments through an outside party to conceal the true source.” This activity may prevent law enforcement from uncovering or confiscating the proceeds of crime, or using the proceeds as evidence in a criminal prosecution. Such processing may involve disguising the beneficial owner of either the actual criminal proceeds or of other property that might be subject to confiscation. Money laundering can be done with or without the knowledge of the financial institution or counterparty to financial transactions, although to be guilty of the crime of money laundering, actual or implied knowledge is required.

The number and variety of transactions used to launder money has become increasingly complex, often involving numerous financial institutions from many jurisdictions, and increasingly using non-bank financial institutions. In addition laundered proceeds may not be cash but other financial instruments. Also, the use of non-financial businesses and markets for laundering appears to be increasing, including not only illegitimate institutions such as shell companies created as laundering instrumentalities, but legitimate companies where illicit funds are intermingled with legitimate funds.

Money laundering methods are diverse and are constantly evolving. They range from trade related operations to on-line banking. Money launderers may also operate outside financial systems, for example, through alternative remittance systems. Other financial crimes can be associated with, or exist in parallel with, money laundering, for example, corruption, fraud, or the control of a financial institution by organized crime. Upon the receipt of criminal proceeds, criminals may seek to launder them through the financial system. This, in turn, may also require a series of fraudulent activities such as counterfeiting invoices and the corrupting of bank employees. Thus, a whole chain of criminal or illegal activities may culminate in the flow of

criminal money through the financial system.

Money Laundering process and methods

Money laundering is not a single act but is in fact a process that is accomplished in three basic steps. These steps can be taken at the same time in the course of a single transaction, but they can also appear in well separable forms one by one as well.

ANTI-MONEY LAUNDERING (AML)

Anti-money laundering (AML) is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent, detect, and report money laundering activities. Anti-money laundering guidelines came into prominence globally as a result of the formation of the Financial Action Task Force (FATF) and the promulgation of an international framework of anti-money laundering standards. These standards began to have more relevance in 2000 and 2001, after FATF began a process to publicly identify countries that were deficient in their anti-money laundering laws and international cooperation, a process colloquially known as “name and shame”.

An effective AML program requires a jurisdiction to have criminalized money laundering, give the relevant regulators and police – the powers and tools to investigate; be able to share information with other countries as appropriate; and require financial institutions to identify their customers, establish risk-based controls, keep records, and report suspicious activities. The effective functioning of financial markets relies heavily on the expectation that high professional, legal, and ethical standards are observed and enforced. A reputation for integrity, soundness, honesty, adherence to standards and codes is one of the most valued assets by investors, financial institutions, and jurisdictions. Various forms of financial system abuse may compromise financial institutions’ and jurisdictions’ reputations, undermine investors’ trust in them, and therefore weaken the financial system. The important link between financial market integrity and financial stability is underscored in the Basel Core Principles for Effective Supervision and in the Code of Good Practices on Transparency in Monetary and Financial Policies, particularly those principles and codes that most directly address the prevention, uncovering, and reporting of financial system abuse, including financial crime, and money laundering.

Money laundering may have other negative macroeconomic consequences. For example, it could compromise bank soundness with potentially large fiscal liabilities, lessen the ability to attract foreign investment, and increase the volatility of international capital flows and exchange rates.

Applicability of anti-money laundering laws

Anti-money laundering laws will be applicable to every individual or entity engaged in financial transactions

Sec.2(1)(ha) of Prevention of Money-Laundering Act, 2002 (inserted by Prevention of Money Laundering (Amendment) Act, 2012) defines “Client” as a person who is engaged in a financial transaction or activity with a reporting entity and includes a person on whose behalf the person who engaged in the transaction or activity, is acting

According to Sec.2(1)(s) of Prevention of Money-Laundering Act, 2002 “person” includes—

(i)an individual,

(ii)a Hindu undivided family,

(iii)a company,

(iv)a firm,

(v)an association of persons or a body of individuals, whether incorporated or not,

(vi)every artificial judicial person not falling within any of the preceding sub-clauses, and

(vii)any agency, office or branch owned or controlled by any of the above persons mentioned in

the preceding sub-clauses.

According to Sec.2(1)(wa) of the Prevention of Money-Laundering Act, 2002 (inserted by Prevention of Money-Laundering (Amendment) Act, 2012) “Reporting entity” means a banking company, financial institution, intermediary, or a person carrying on a designated business or profession.

“Banking company” means a banking company or a co-operative bank to which the Banking Regulation Act, 1949 (10 of 1949) applies and includes any bank or banking institution referred to in section 51 of that Act. (Sec.2(1)(e) of Prevention of Money-Laundering Act, 2002)

“Financial institution” means a financial institution as defined in clause (c) of section 45-I of the Reserve Bank of India Act, 1934 and includes a chit fund company, a housing finance institution, an authorized person, a payment system operator, a non-banking financial company and the Department of Posts in the Government of India. (Sec.2(1)(l) of Prevention of money laundering Act, 2002)

Identity Verification Solutions

From eID we offer KYC (Know Your Customer), customer onboarding and digital identity solutions and services that help our customers to provide theirs a unique, simple, frictionless, high-security experience that meets the highest standards required in international regulations. AML (Anti-Money Laundering) and eIDAS (Electronic Identification, Authentication and etrust Services) regulations are remodeling the market by allowing customer acquisition processes to be reduced from weeks to seconds to, for example, open a bank account online with total security and complying with the law.

Our Video IDentification, Advanced and Qualified Electronic Signature, and Facial Biometric Authentication services are transforming the way in which companies and customers interact. Current eKYC solutions, powered by Artificial Intelligence and Machine Learning allow businesses in any sector, such as banking, insurance, financial and investment services, to be digitally transformed, reduce digital customer onboarding costs and grow by offering a unique user experience.

AML | Anti-Money Laundering

- RegTech Company

- 5AMLD deadlines

- 6AMLD Regulation

- What is KYC (Know Your Customer)

- eKYC meaning

- What is Know Your Business (KYB)

Electronic Signature

- SignatureID, digital signature

- Advanced Electronic Signature

- eIDAS and electronic signature

- eSignature Contracts

- Certification Authorities

Video IDentification

- What is IDentity Verification

- 5AMLD deadlines

- Picture-based digital identification not

- VideoID vs face-to-face identification

- What is Digital Onboarding

- Digital Onboarding in banking

Video IDentification

- SmileID: Digital authentication service

- Biometric facial recognition

- Face biometrics in payment

- Facial biometrics eSignature

- Facial Biometric Access Control